Alpha Edge Recognition - Credit-Oriented Hedge Fund Strategies

This year, Allocator Intel will be recognizing leaders in the allocator community, acknowledged by their peers, for exceptional leadership in key areas of portfolio construction in the Alpha Edge Recognition Awards.

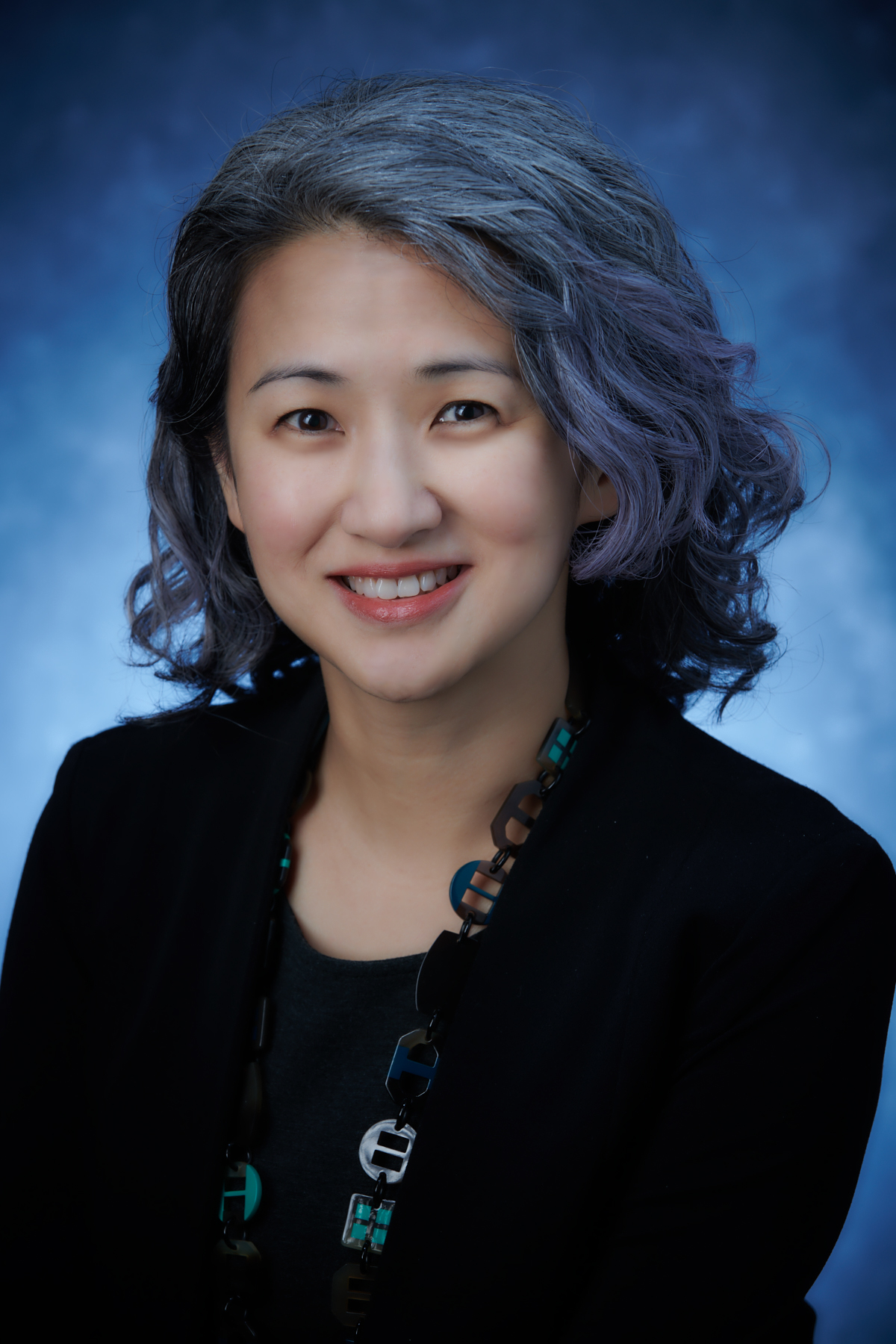

Sophia Tsai, Managing Director at Trinity Church Wall Street, is nominated for Credit-Oriented Hedge Fund Strategies. During her five years at the $7 billion endowment, she has added opportunistic credit managers ahead of credit dislocations, built the private equity portfolio entirely from scratch, incorporated secondaries and co-investments into the asset allocation, and expanded diversity by actively partnering with emerging managers.

After Sophia received her Bachelor of Business Administration from the Chinese University of Hong Kong, she worked for GE Capital in Asia for 10 years. She received her MBA from the Hong Kong University of Science and Technology and Kellogg School of Management and joined GE Pension in the US. At GE Pension, she managed the global hedge fund and private equity portfolios as Co-Chief Investment Officer of Hedge Funds and Senior Managing Director — before spending a year in a similar role at State Street (post-GE Pension acquisition).

At Trinity Church Wall Street, she has made her mark since she joined at the end of 2017. Besides portfolio management, she has also helped hire the team, define the investment process, nurture the culture, and market the institution.

The following is edited for length and clarity.

Tell us a little bit about the overview of what your portfolio looks like today.

Tell us a little bit about the overview of what your portfolio looks like today.

Our portfolio is close to $7 billion of AUM. Out of that, half is commercial real estate in Manhattan (We inherited a large land grant back in 1705 from the Queen of England); the other half is a diversified portfolio that is managed like a typical endowment — 75% equity, 25% fixed income. The Church hired Meredith Jenkins as its first CIO in 2016. I joined at the end of 2017 as employee Number 4, and the team was essentially a startup for the non-real estate portfolio.

Higher interest rates have created interesting opportunities in credit, uncorrelated, and special situation strategies, so I think it is much more exciting now that we have things that are driving performance and returns, other than technology and growth.

What are some of the factors you look for in terms of opportunities?

Today, we have a more built-out process, team, and culture, but we continuously look for opportunities to upgrade the portfolio. We are spending more time on portfolio construction and resizing positions based on the role each manager plays and how each manager can be accretive to our overall portfolio. With volatility and uncertainty increasing in the macro and geopolitical environment, it is important to manage the portfolio from a risk perspective: For the last three years, you have seen COVID, the Ukraine/Russian war, and increased U.S./China tensions.

It is hard for an endowment to pivot quickly, but we do make certain strategic tilts to adjust the risk profile of the portfolio. We also rely on investment managers to help us pivot. Cycles are getting shorter, and we need to proactively invest in these managers ahead of market dislocations. For example, in 2019 we invested in two credit managers with the thesis that they would take advantage of credit dislocations as they arise.

Both managers have purchased dislocated investment grade bonds in 2020. One of them was among the early movers to take advantage of the energy transition theme in 2021 and to de-gross in 2022 ahead of the sector downturn.

When looking at strategic partnerships, when you’re seeking out asset managers to work with, what are some of the key factors you’re looking at?

I would say for me, Number 1 is to focus on why: “What motivates the manager? Why do they want to create another fund?” I think that affects how they build the culture, the team, the process, and a firm that creates long-term sustainability. I often ask managers in the first meeting, “How is your strategy differentiated from others?”

I think value and interest alignment with managers are very important, and the way we get to know our managers is to continue to stay close to them. One effective way is to visit companies with managers. I traveled with managers in Vietnam and Singapore in November last year, and Japan and South Korea this past May.

What about the next 12 to 18 months?

There are interesting opportunities in the more liquid credit dislocation strategies, mostly in the public market. There are also opportunities where Trinity can benefit from becoming a liquidity provider in the secondary private equity market. In our private equity portfolio, we have limited our late-stage venture exposure in the last few years, but proactively reserved dry powder this year and next year to buy quality growth assets that have sold off 50% to 60% from the peak.

One thing that won’t change is how motivated our investment team is in supporting the mission of the Church on homelessness and racial justice, doing good, and doing well. A large part of our portfolio is composed of emerging managers and diverse managers who have short track records. They have been performing just as well if not better than the rest of the portfolio; I view myself as an underdog and can relate to emerging managers who hustle to survive, and I hope to continue to help them succeed.

What do you spend most of your time involved in outside your job?

Outside of Trinity, I have been spending more time on non-profits whose missions I care about deeply. I have been on the steering committee of the Private Equity Women Investor Network (PEWIN) for over a decade. In 2020, I co-founded Institutional Allocators for Diversity, Equity, and Inclusion (IADEI) with my Trinity colleague, Bhakti Mirchandani, and Rob Rahbari and Stephanie Weston of University of Rochester. Today, IADEI has more than 700 allocator members who are actively engaged to increase diversity in the industry through an open-source diverse manager database, regular manager pitch sessions, and content sessions. I am also an investment committee member of the Patrick J. McGovern Foundation which supports organizations that advance AI and data solutions to create a more equitable and sustainable future.

I am a mother of two children, my teenage daughter and almost-teenage son. I love to travel and see the world with my family.

For more content of Investor Week, visit the group here.

To discuss the content of this article or gain access to like content, log in or request membership here.