By Michael Hunstad, Ph.D., Director of Quantitative Research, Northern Trust Asset Management

The basics of factor investing, why it can work, and how to use it in a portfolio

While we have run factor-based strategies for more than 20 years, we know that many investors are still learning the basics. Here are some common questions we hear from investors and clients.

#1: What are factors?

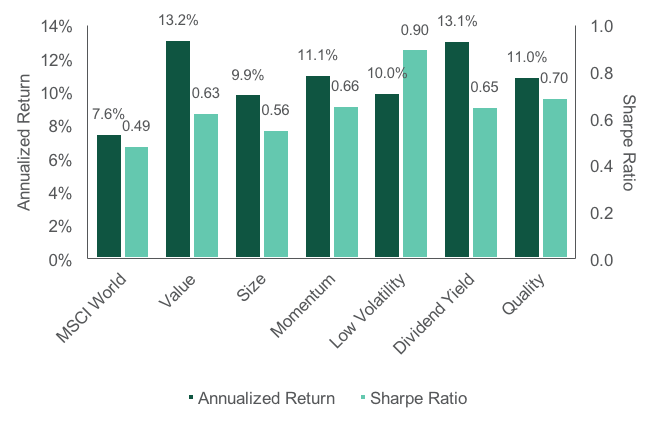

Factors are systematic forms of equity returns that have historically outperformed capitalization-weighted benchmarks over the long-term (see Exhibit 1). For example, we are most interested in companies and investments that fit our criteria for the momentum, low volatility, value, size, dividend and quality factors because they historically have outperformed the market. We search for companies that fit the criteria for these factors. For example, with quality, we invest in companies based on more than a dozen criteria including those related to profitability, management efficiency and cash flow.

With factors, you are not going to outperform the benchmark by 700 basis points. No factor strategy can do that. What you want to do is maximize the return per unit of risk. In other words, you want to achieve the best use of risk possible.

Factors are not a new idea. They trace back to Benjamin Graham’s work on value investing in the 1930s, William Sharpe’s capital asset pricing model (CAPM) in the 1960s regarding the market risk factor, and Eugene Fama and Kenneth French in the 1990s who focused on the three-factor model of market risk, value and size.

#2: What Are the Advantages of Factors?

Exhibit 1 shows this the best. Historically, the factors shown have performed well in terms of excess returns versus the benchmark. This is sort of interesting in the sense that higher returns are nice. However, the Holy Grail of investing is return per unit of risk. With factors, investors can potentially earn more return with correspondingly less risk. We found that no matter how we dissect the world into regions and countries, we tend to see these same patterns in factors.

Exhibit 1: Factor Investing: The Historical Risk-Adjusted Advantage: Equity factors represent distinct sources of return and risk that have historically provided more persistent return. Risk/return profiles of the six factors from 1997 to 2016 have been compelling versus the MSCI World Index.

Source: Northern Trust Quantitative Research, as of 12/31/16. This graph does not show actual performance results. For illustrative purposes only. Please see important information on hypothetical returns at the end of this presentation. Note: MSCI World index data is shown. Past performance is no guarantee of future results. Index performance returns do not reflect any management fees, transaction costs or expenses. It is not possible to invest directly in any index.

#3: How do I use factors in my portfolio?

We think they work best as core holdings. The vast majority of our clients are using them as such. What is the best mix of factors? Largely, it depends on the investor’s circumstances, but we prefer diversified exposure to multiple factors. Most of our clients are garnering exposure to all or many of them.

Start with the outcome you are looking for, and then find the right combination of factors to achieve that outcome. A total factor portfolio likely would work better than layering in factor investments. Once you know the outcome you’re looking for, you can create a portfolio of harmonious factor strategies to give yourself the best chance of achieving that outcome.

It’s important to be wary of over simplified factors. We receive a lot of calls from investors who are disappointed in their factor-based strategies because of high, unintended correlations with commodities or certain sectors such as utilities or consumer staples.

#4: What are the risks of factor investing?

Factor cycles: All factors tend to go through prolonged periods of underperformance. There are potentially two solutions. The first is to try to time when a factor will come into favor and time when it won’t. As with market timing in any type of investment, we have found this to be difficult. Secondly, you can create a multi-factor portfolio to smooth out the cycles. We have done this with all of our factor strategies since the beginning. In particular, we have found that pairing the quality factor with various other factors has worked well.

Unintended risks: Naïve factor portfolios can produce significant unintended risks. As investors tilt toward value, low volatility or quality, they tend to get a lot of extraneous risks that come along for the ride. For example, low volatility strategies tend to have heavy sector exposures to utilities and consumer staples as well as significant idiosyncratic risk. Factor exposures can be inadvertently mixed together; a quality strategy can include too much large cap risk. In fact, last year, we analyzed 20 large factor-based strategies in the market. We found that 83% of the risks were unintended. That’s frightening. Only 17% of active risk, on average, was properly aimed at the intended factor. We are mindful of this problem and we aim to build our strategies with the purest exposure possible.

Learn more about how to get started with factor-based investing in your portfolio through the webinar Answering the Toughest Questions on Factor Investing.