Deep Dive into the Dutch Market

This November, Institutional Investor and MN co-hosted an exclusive event, inviting 75 of the most sophisticated asset allocators to the annual Netherlands Summit in The Hague. Held at the Hilton hotel over two days, investors, and a select number of top-tier asset managers, connected and engaged in meaningful discussions across a variety of key topics. The present geopolitical upheaval, and current volatility on markets, resulted in debates on how long-term investors in both public and private markets should respond. This is particularly timely given ongoing developments in the Dutch DC pension landscape.

Ahead of the Summit, Institutional Investor presented a snapshot of key themes and trends investors had shared with us over the last 6 months. A total of 44 institutional investors were surveyed, of which 45% were Fiduciary Managers, 16% Corporate Pension Funds, 16% Multi-Employer Pension Funds, 7% Family Offices, 7% Consultants, 5% Insurers and 4% other.

Below we present quantitative investment intention as part of a section entitled ‘what we are seeing’, and idiosyncratic, qualitative insights through a section called ‘what we are hearing’.

If you have any questions and would like to have access to the full report please contact andries.vanniekerk@iilondon.com

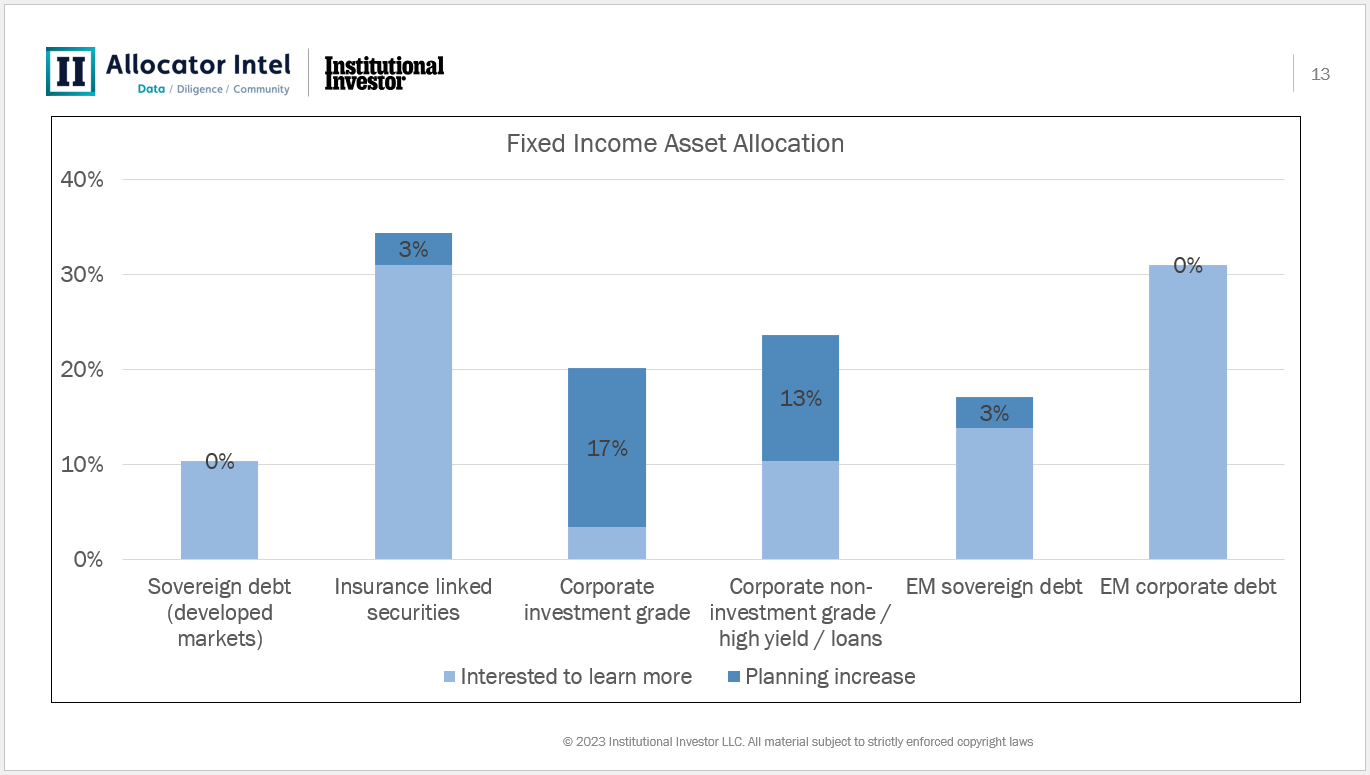

Fixed Income

Corporate investment grade and non-investment grade opportunities see planned execution relative to little planned execution in emerging markets.

There is strong interest across all fixed income sub-asset classes with particular interest, 31% of survey respondents, in EM corporate debt though the strongest interest to know more is inversely proportional to planned allocation,

ILS strategies are also showing strong levels of interest and some planned execution with investors perhaps valuing a less correlated driver of return.

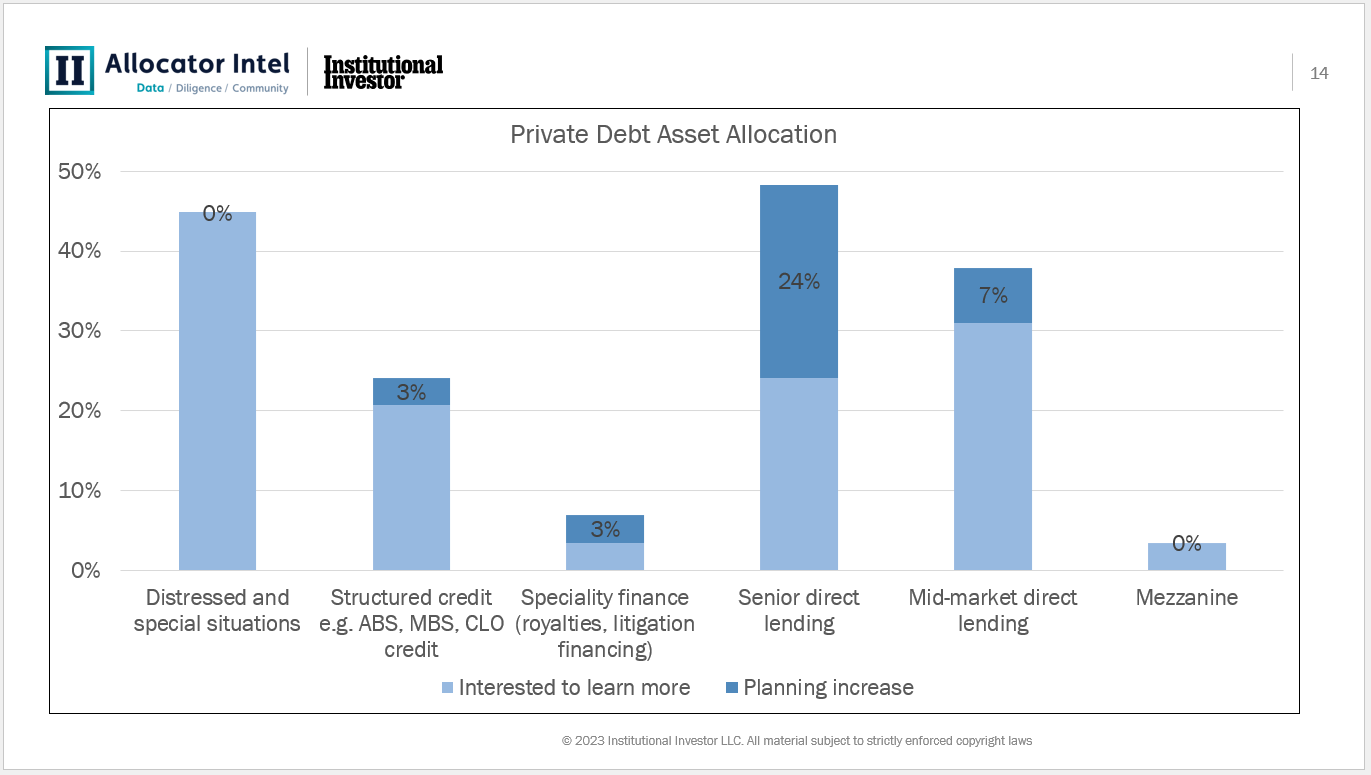

Private Debt

There is a mixed picture within Private Debt. Senior direct lending has very strong levels of planned execution but elsewhere it is more limited.

Structured credit and specialty finance have small levels of planned investment.

As with fixed income, the highest area of interest to know more shows the smallest amount of planned execution. Distressed and special situations is by far the area with most interest but has no planned execution.

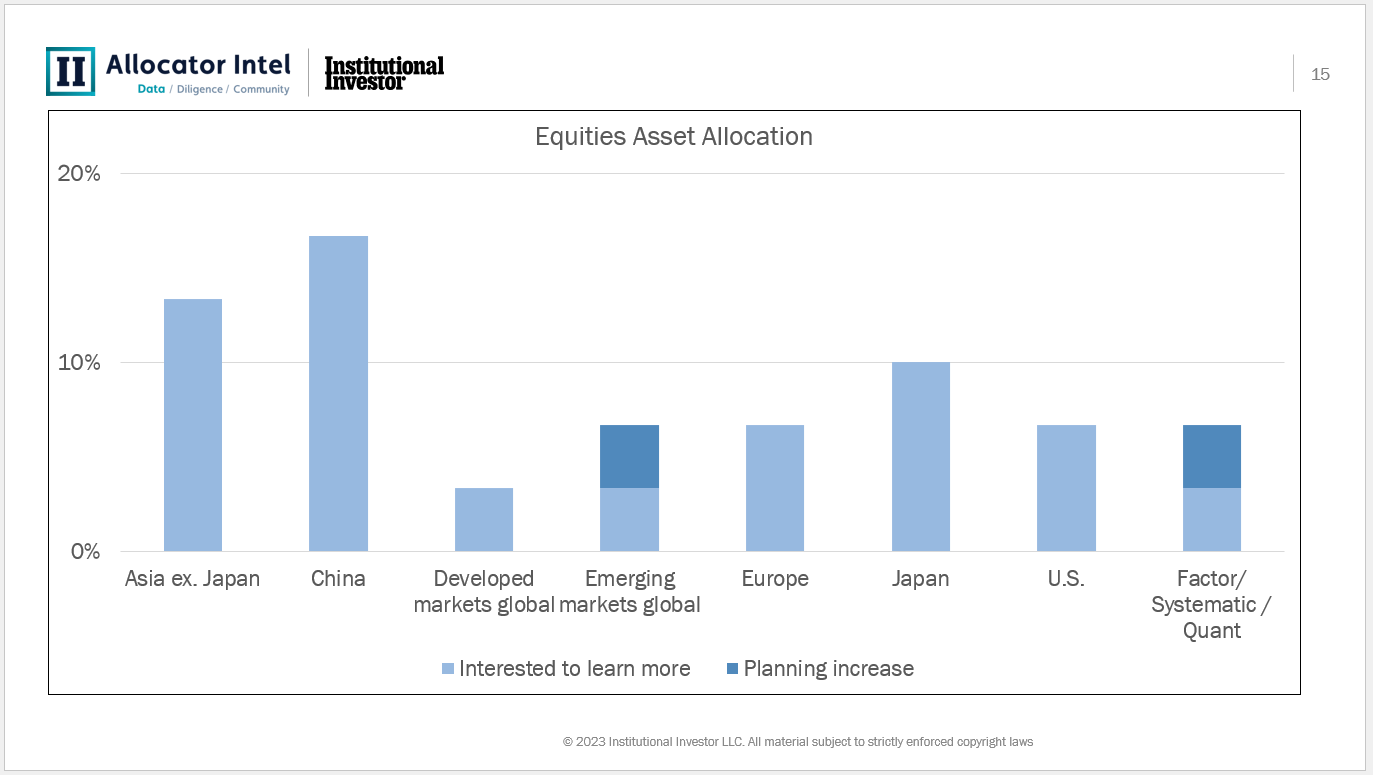

Public Equities

There is a notable lack of interest across equity sub-asset classes. This is particularly noticeable in developed markets with Europe, US and global DM particularly low

Execution is also minimal with EM global seeing some planned increases, 4% of respondents, alongside with factor opportunities, also 4%, perhaps in light of a rotation towards different investment styles.

China and Asia EM excluding Japan are piquing the interest of investors but this hasn’t translated to execution decisions.

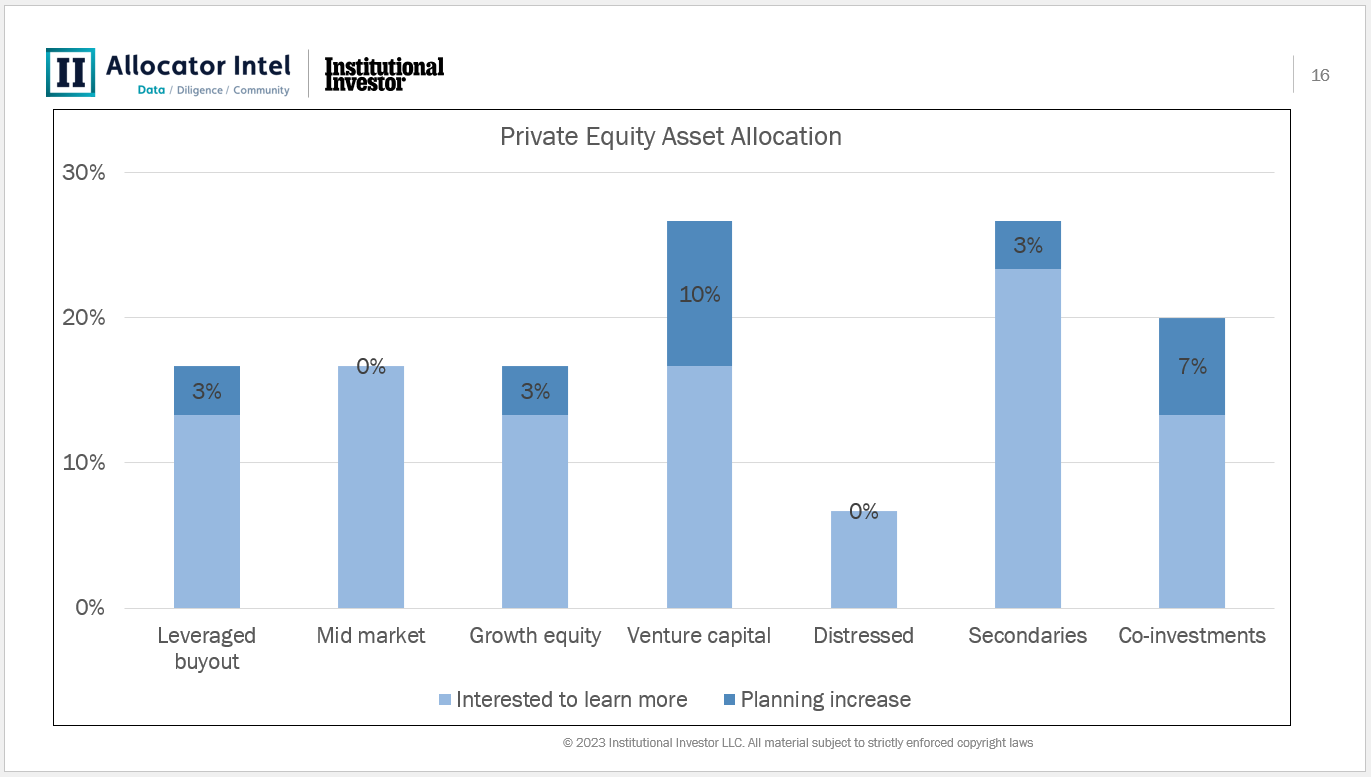

Private Equity

Venture capital and co-investments are the strongest performing in terms of planned execution with secondaries also having moderate levels of execution and very strong levels of interest.

Once again, high levels of interest are correlated with lower planned execution in secondaries.

Leveraged buyout and growth equity have fairly muted execution but again resilient levels of interest shown in them. This is similar in mid-market despite the lack of planned investment.

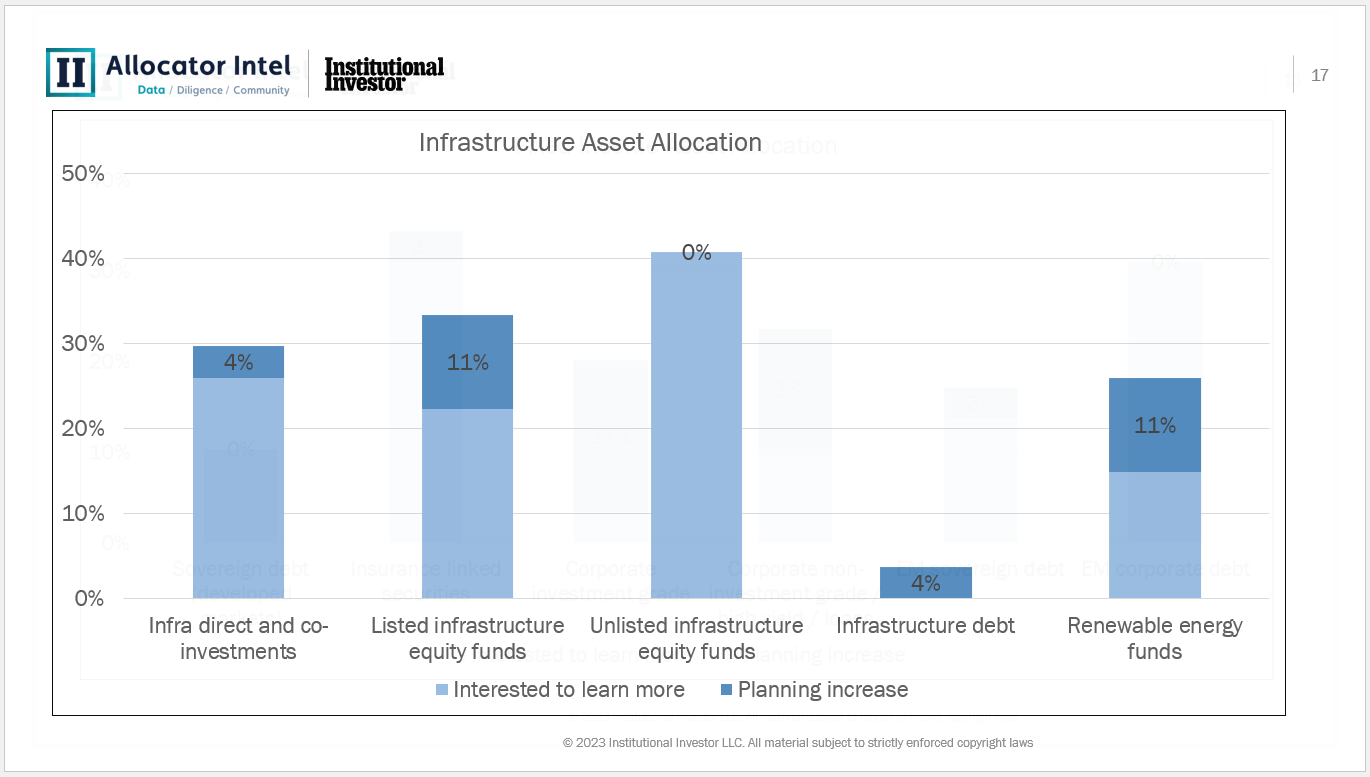

Infrastructure

Planned execution is focused on renewable energy funds and listed infrastructure equity funds. The energy transition may be the driver of a strong desire for renewable energy fund investments with 10% of respondents planning increases here.

Unlike the rest of Europe, infrastructure debt has much more muted appetite and planned execution.

Unlike real estate, listed infrastructure opportunities do have strong levels of appetite and planned executions. More surprisingly, there is limited planned new execution in unlisted infra but over 40% of respondents interested to learn more.

Direct infra and co-investments fairly resilient with more than 25% of respondents either looking to invest or learn more.

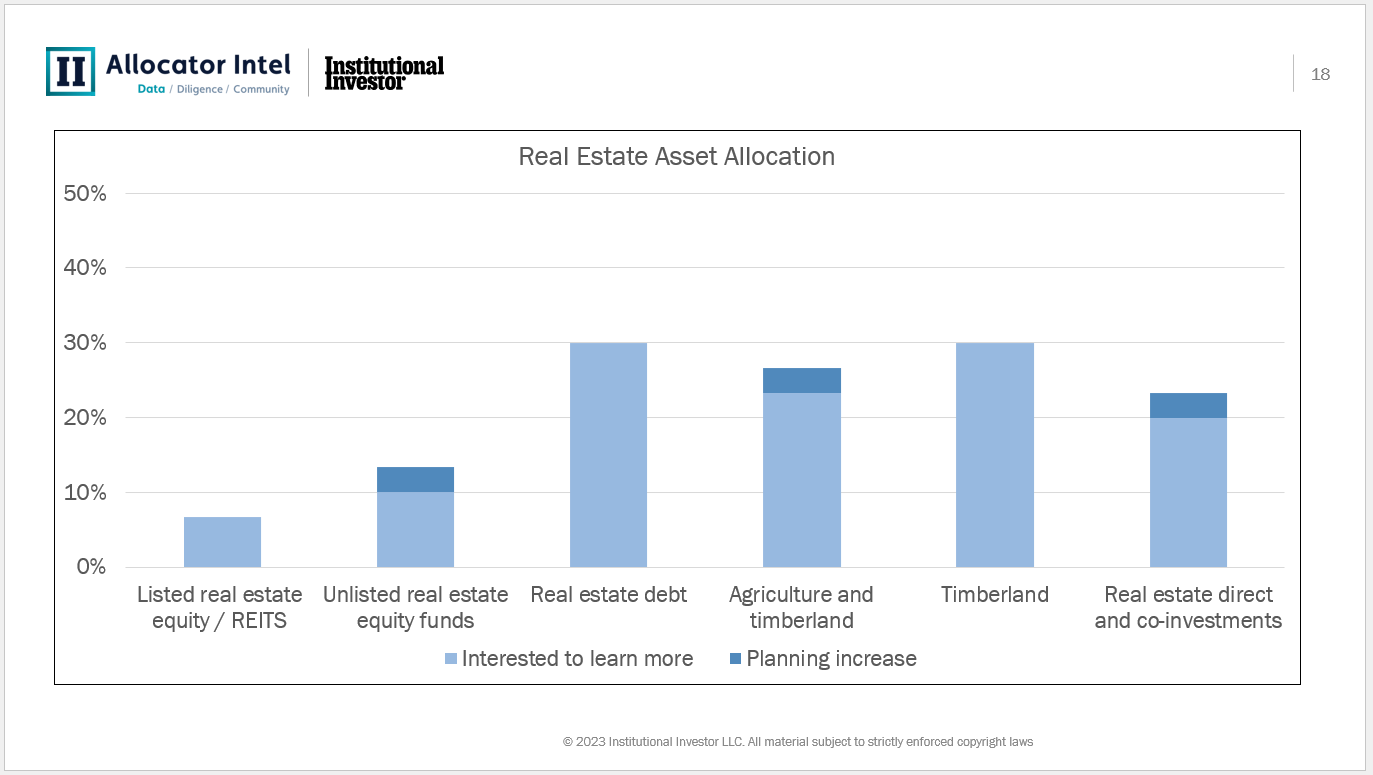

Real Estate (including Agriculture & Timberland)

In line with a challenging environment for real estate, there is limited planned execution across the board.

Unlisted real estate, direct real estate as well as agriculture/timberland are the exceptions to a lack of activity, but no more than 5% of respondents planned increases to any of these sub-asset classes.

Listed real estate equity is particularly muted with minimal interest and no planned executions. Timberland and Real Estate debt have some more interest but, again, no execution planned.

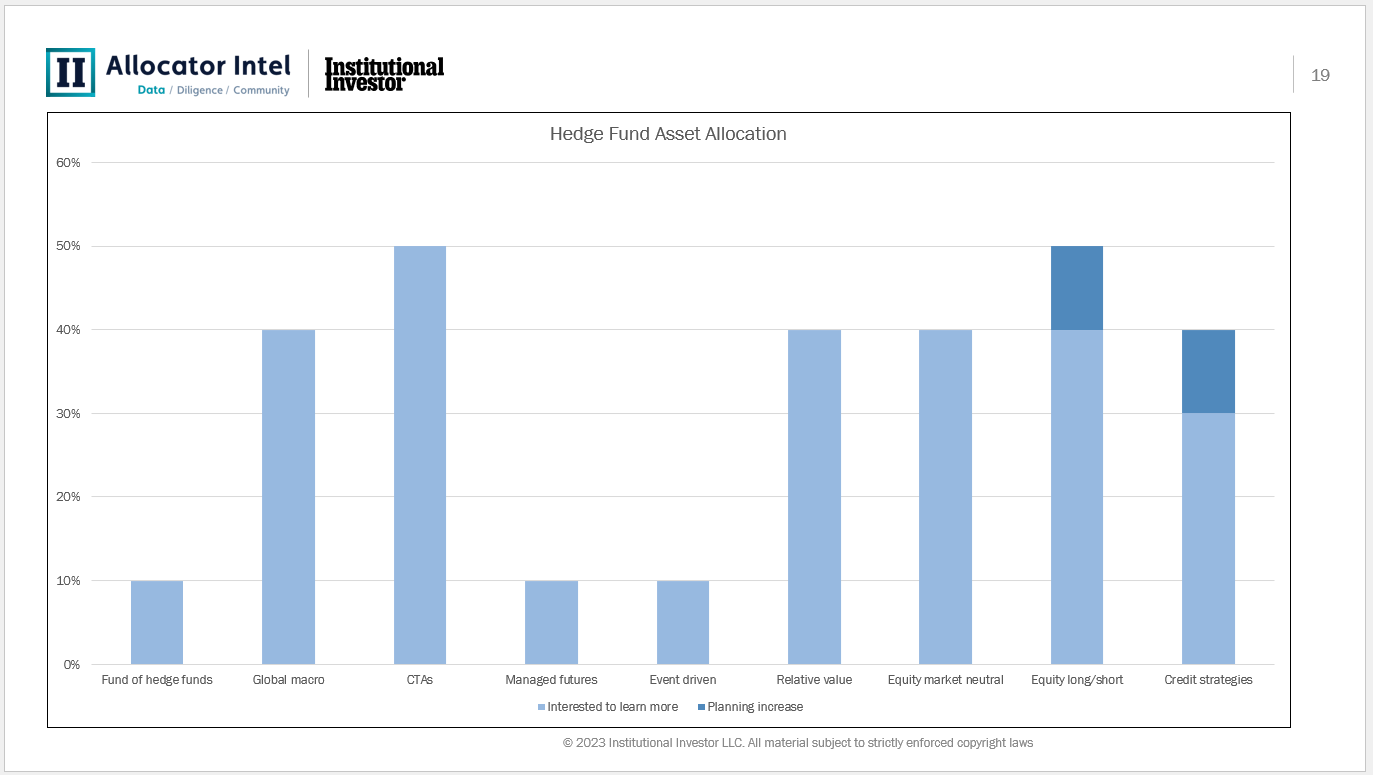

Hedge Funds

There is strong interest across the board within hedge funds with the exception of event driven, managed futures and fund of hedge funds.

CTAs are generating a lot of interest in light of the volatile macro environment.

It is traditional equity long/short that is generating planned activity alongside credit strategies. 10% of survey respondents plan increases to these two sub-asset classes.

To discuss the content of this article or gain access to like content, log in or request membership here.