Take a look at your stock allocation. A good dose of low volatility equity might surprise you.

by Matt Peron, Managing Director of Global Equity, and Ben Goetsch, CFA, Equity Strategist

Low volatility equity strategies have defied traditional assumptions about how risk and return pair up, based on our historical research. This is what makes low volatility such a valuable factor. Most discussions of low volatility strategies have tended to focus on the potential to outperform cap-weighted benchmarks by overweighting low volatility stocks. While this is clearly interesting and merits attention, it ignores perhaps the most important feature of a low volatility strategy — the ability to potentially improve the risk-return profile of a portfolio.

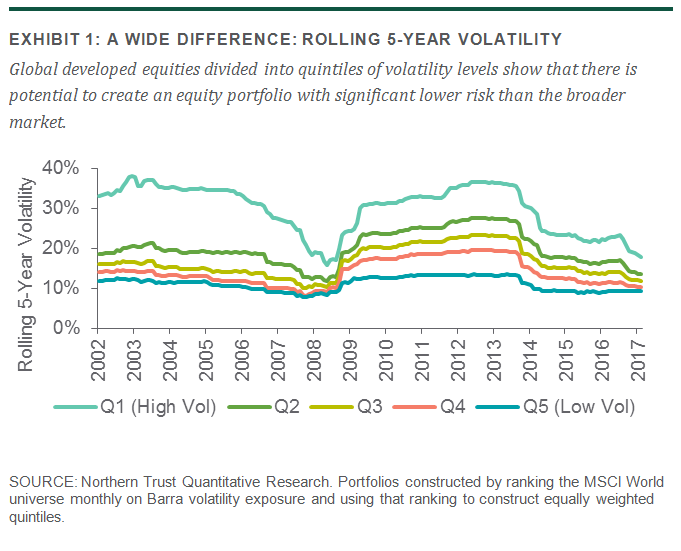

A Wide Range of Risk

Historical patterns clearly indicate that volatility is far from uniform across equities. In Exhibit 1, we divided developed-market equities into five portfolios (quintiles from lowest volatility to highest) based on historical volatility. The resulting portfolios demonstrate a range of volatility, indicating that stocks identified as low volatility tend to be significantly less volatile in the future than stocks identified as high volatility.

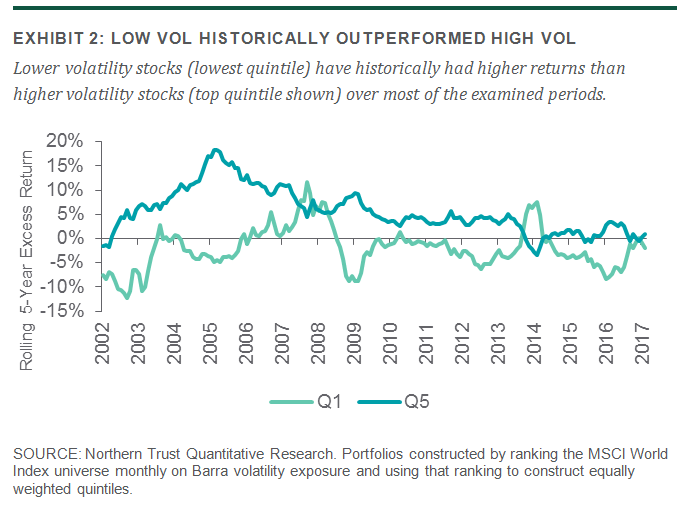

Performance: Low Volatility Stacks Up Well Historically

If traditional financial theory holds true, we should assume that portfolios with significantly different levels of risk should also demonstrate significantly different levels of return. Specifically, higher volatility portfolios should be rewarded with higher levels of return, and lower volatility portfolios should demonstrate commensurately lower returns. Exhibit 2 clearly indicates that has not been the case.

Using only the highest quintile and lowest quintile for clarity, we calculated the excess returns relative to the broader market. Not only do the lowest volatility stocks tend to keep up with the broader market, but they actually outperform higher volatility stocks over nearly every 5-year period we examined.

Put Low Volatility to Use: Fine-Tuning the Risk and Reward

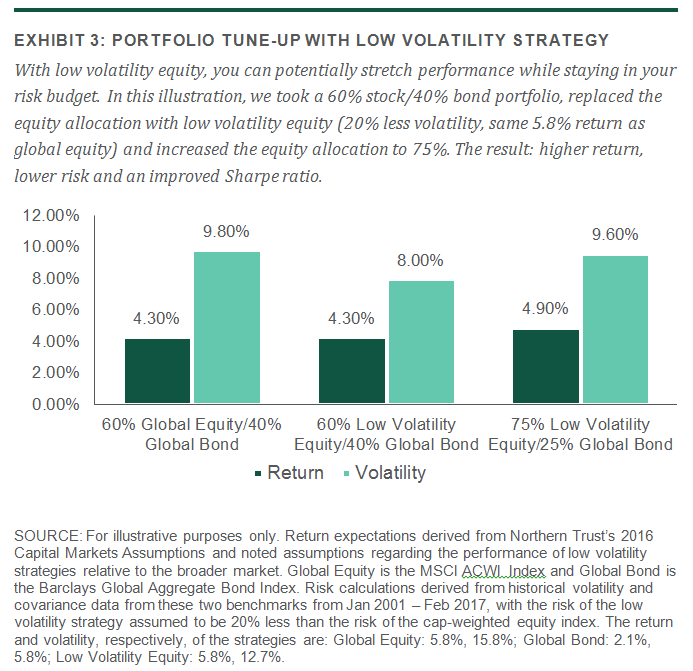

This finding can have broad implications, particularly in an environment where return expectations across asset classes are at historically low levels. Our research and experience suggest that low volatility strategies that are reasonably well diversified can deliver 20% to 30% less volatility versus the broader market. Even if a low volatility portfolio could simply match the performance of the broader market, investors can expand their equity allocations and increase return potential without increasing portfolio volatility.

To illustrate, in Exhibit 3, we use a sample portfolio allocated 60% to equities and 40% to bonds. We can replace the equity allocation with a low volatility strategy that performs in line with the cap-weighted benchmark with 20% less volatility, on the low end of the expected volatility reduction. If we increase the low volatility equity allocation to 75%, we can achieve improved historical return with less volatility. Further, more equity can mean more return potential going forward.

For investors grappling with the potential for low returns in the intermediate-term, low volatility strategies provide an interesting tool to potentially improve performance within their existing risk budgets. Not only do these strategies present the opportunity for outperformance within equity allocations, but their lower risk profile allows for potential shifts in asset allocation to boost returns without increasing overall portfolio volatility. Further, while we expect low volatility strategies to deliver a premium relative to the market over time, as these strategies have done historically, investors can still benefit from the improved risk/return tradeoff.

Learn More

Factor-Based Investing: Put Risk to Work in Your Favor

Global Low Volatility: Benefiting From an Actively Designed Approach

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. Northern Trust and its affiliates may have positions in and may effect transactions in the markets, contracts and related investments different than described in this information. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of Northern Trust and are subject to change without notice.

This report is provided for informational purposes only and is not intended to be, and should not be construed as, an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Recipients should not rely upon this information as a substitute for obtaining specific legal or tax advice from their own professional legal or tax advisors. References to specific securities and their issuers are for illustrative purposes only and are not intended and should not be interpreted as recommendations to purchase or sell such securities. Indices and trademarks are the property of their respective owners. Information is subject to change based on market or other conditions.

All securities investing and trading activities risk the loss of capital. Each portfolio is subject to substantial risks including market risks, strategy risks, adviser risk and risks with respect to its investment in other structures. There can be no assurance that any portfolio investment objectives will be achieved, or that any investment will achieve profits or avoid incurring substantial losses. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Risk controls and models do not promise any level of performance or guarantee against loss of principal. Any discussion of risk management is intended to describe Northern Trust’s efforts to monitor and manage risk but does not imply low risk.

Past performance is no guarantee of future results. Performance returns and the principal value of an investment will fluctuate. Performance returns contained herein are subject to revision by Northern Trust. Comparative indices shown are provided as an indication of the performance of a particular segment of the capital markets and/or alternative strategies in general. Index performance returns do not reflect any advisory fees, transaction costs or expenses. It is not possible to invest directly in any index. Performance returns are reduced by investment management fees and other expenses relating to the management of the account. Performance returns contained herein include reinvestment of dividends and other earnings, transaction costs, and all fees and expenses other than investment management fees, unless indicated otherwise. Gross performance returns do not reflect the deduction of investment advisory fees and returns will therefore be reduced by these and any other expenses occurred in the management of the account. For additional information on fees, please refer to Part 2a of the Form ADV or consult a Northern Trust representative.

Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information.

If presented, hypothetical portfolio information provided does not represent results of an actual investment portfolio but reflects representative historical performance of the strategies, funds or accounts listed herein, which were selected with the benefit of hindsight. Hypothetical performance results do not reflect actual trading. No representation is being made that any portfolio will achieve a performance record similar to that shown. A hypothetical investment does not necessarily take into account the fees, risks, economic or market factors/conditions an investor might experience in actual trading. Hypothetical results may have under- or over- compensation for the impact, if any, of certain market factors such as lack of liquidity, economic or market factors/conditions. The investment returns of other clients may differ materially from the portfolio portrayed. There are numerous other factors related to the markets in general or to the implementation of any specific program that cannot be fully accounted for in the preparation of hypothetical performance results. The information is confidential and may not be duplicated in any form or disseminated without the prior consent of Northern Trust.

This information is intended for purposes of Northern Trust marketing of itself as a provider of the products and services described herein and not to provide any investment recommendations or advice within the meaning of the Department of Labor’s Final Fiduciary Rule (29 CFR §2510.3–21). Northern Trust is not undertaking to provide impartial investment advice or give advice in a fiduciary capacity to the recipient of these materials. To the extent that the recipient of these materials has authority to act on behalf of a benefit plan that is subject to Title I of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), Northern Trust provides information with the understanding that the recipient: (1) is a fiduciary under ERISA with respect to any plan transaction(s) contemplated herein and is responsible for exercising independent judgment in evaluating any such transaction(s); (2) is independent of Northern Trust; (3) is a bank or similarly regulated financial institution, insurance carrier, registered investment adviser, registered broker-dealer, or a plan fiduciary that holds, or has under management or control, total assets of at least $50 million; (4) is capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Please advise Northern Trust immediately if any of the foregoing understandings is incorrect. Further, Northern Trust and its affiliates receive fees and other compensation in connection with the products and services described herein as well as for custody, fund administration, transfer agent, investment operations outsourcing and other services rendered to various proprietary and third party investment products and firms that may be the subject of or become associated with the services described herein.

© 2017 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For more information, read our legal and regulatory information about individual market offices (available at northerntrust.com/disclosures). Northern Trust Asset Management comprises Northern Trust Investments, Inc., Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K., NT Global Advisors, Inc. and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company. In Singapore, Northern Trust Global Investments Limited (NTGIL) and Northern Trust Investments, Inc. are exempt from the requirement to hold a Financial Adviser’s Licence under the Financial Advisers Act and a Capital Markets Services Licence under the Securities and Futures Act with respect to the provision of financial services. In Australia, NTGIL is exempt from the requirement to hold an Australian Financial Services Licence under the Corporations Act 2001 in respect to the provision of financial services. NTGIL is regulated by the FCA under U.K. laws, which differ from Australian Laws. Issued by Northern Trust Global Investments Limited.