By Mamadou-Abou Sarr, Global Head of ESG and Julia Kochetygova, Senior ESG Research Analyst

Northern Trust Asset Management

Impact ESG investing can be channeled and measured through `do no harm’ and global sustainable development goals.

Impact investing is investment made into companies, organizations, and funds with the intention to generate a double bottom line with positive social and/or environmental impact alongside a financial return. While true environmental, social and governance (ESG) impact investing can be a discipline in itself, you can take some steps right now. Here are some ways to be impactful with your asset allocation.

A good place to start: do no harm

For investors looking to take steps towards impactful investing, a good place to start is with the concept of doing no harm — a base line for investors to look at their portfolio and remove any exposures that might have a negative ESG impact.

With this approach, consider whether companies in which you invest are applying efforts to minimize negative externalities of their operations and ensure that, ultimately, the net impact of their operations is not negative.

For a company to do no harm, the management and board need to put substantial effort into enhancing various measurement and control systems (for carbon emissions, resource consumption, waste production, etc.). Further efforts would be needed for raising awareness and focus throughout the organization. It would involve developing policies and mitigation strategies, setting performance targets and linking the incentives to their achievement. They will also need to apply such impact management across the whole value chain including supplies, production, distribution, consumption and utilization their products.

We believe the simplest way to quantify such Do No Harm efforts is through ESG scores or ratings. Broad ESG best-in-class equity indices, based on the ESG scores, such as MSCI ESG Leaders, FTSE4Good, STOXX Global ESG Leaders and Dow Jones Sustainability Index, serve as the closest proxies for minimizing ESG related negative externalities.

Go further: sustainable development goals

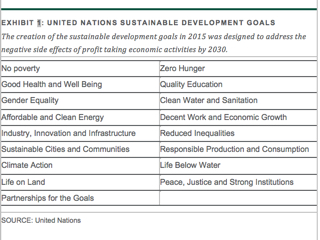

The United Nations has made progress in helping investors measure what qualifies as positive impact with 17 sustainable development goals. These ambitious global goals include no poverty, zero hunger, quality education, gender equality and others listed in Exhibit 1.

Exhibit 1: United Nations Sustainable Development Goals

Investors can go further and look to maximizing positive externalities rather than minimizing negative ones, considering quantitative aspects such as the proportion of revenues coming from sustainable products. These are solutions contributing to sustainable development goals in the most direct way. They include production of renewable energy and engineering systems for it, energy efficient equipment such as LED lighting, meters, controls or insulation, water technologies and infrastructure, electric cars and mass transit transport solutions, recycling options, organic food, water efficient detergents, affordable and healthy housing, microfinance and enablement solutions for elderly and disabled people.

Categorizations of sustainable products are widely available. Dutch pension fund management companies APG and PGGM have jointly produced a taxonomy of sustainable development investments into products and projects aligned with sustainable development goals. The World Benchmarking Alliance launched in September 2017 aims at creating an open-source data and ranking platform, which will produce benchmarks ranking companies on their contribution to the sustainable development goals.

Revenue breakdown data has been used in various indices, such as the FTSE-Russel Green Revenues, Environmental Opportunities and Environmental Technologies Index families, MSCI and Solactive sustainable impact indices, S&P Global Eco Index, and, to a certain extent, the EuroNext Low Carbon 100 Europe Index and STOXX Climate Change Leaders Index. It’s important to note that some indexes can be concentrated given the limited number of companies that meet sustainable criteria, which may increase volatility somewhat versus a broader index.

The power of investor voices

Shareholder stewardship is one of the most powerful ways in which investors can align their investments with sustainability goals and enhance the focus of companies’ economic activities. Through well-coordinated engagement with companies’ management and boards, investors and asset managers can target multiple sustainable development goals.

Investors’ voices are becoming more influential. We have seen shareholder supported proposals pushing Exxon Mobil and Occidental Petroleum to improve the companies’ transparency regarding climate-related risks and opportunities. Seven out of the10 largest listed oil and gas companies globally have now published the analysis of their climate-related risks and opportunities as a result of coordinated engagement and voting efforts of many investors and non-governmental organizations.

Such concentrated efforts aiming at mitigating negative effects of business activities and achieving positive impacts could be less effective if investors focus on a small universe of stocks and bonds.

Conclusion: minimizing the negative, maximizing the positive

In pursuing impactful investing strategies, investors do not have to take a niche approach, focusing on pure-play companies or green projects. The United Nation’s sustainability goals have provided a framework of areas where large-scale investments can be channeled. While measuring and comparing the exact positive impacts of investment portfolios remains a challenge given the variety of locations and specific circumstances, we consider broad-based ESG-focused investments aiming to minimize negative externalities represent a useful tool. Additional overlay focusing on positive efforts by companies can be achieved via indices and assessments based on revenue exposure to sustainable products.