What we are seeing

Thank you for all your contributions to our Credit and Private Credit strategies. We gathered phenomenal data globally and are excited to share this back with you now.

Having collected almost 100 responses from allocators based across 3 regions: North America 61%, Europe 24% and Asia Pacific 15%, we captured an estimated AUM sample size of $1.13 trillion. A large number of respondents (39%) had $20 billion or more in AUM. Half (53%) had between $1 billion and $15 billion. Over one third (39%) had $20 billion or more.

Public retirement funds represented (27%), closely followed by private retirement funds (23%), insurance companies (16%), endowments/foundations (11%), family offices (7%) and health care organizations (4%).

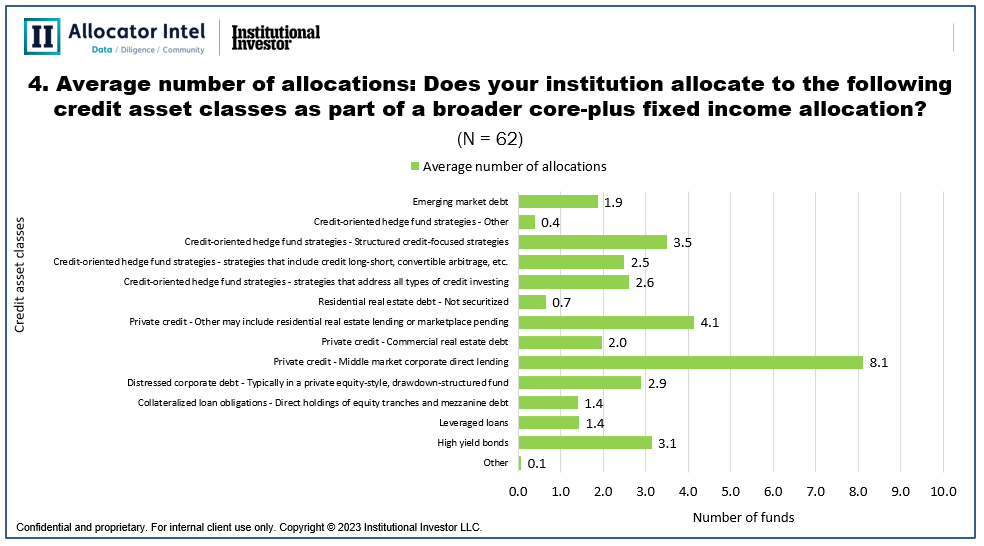

As an average number of funds, respondents allocated most to:

1. Private credit including middle market corporate direct lending

2. Private credit including residential real estate lending or marketplace pending

3. Credit-oriented hedge fund strategies (structured credit-focused)

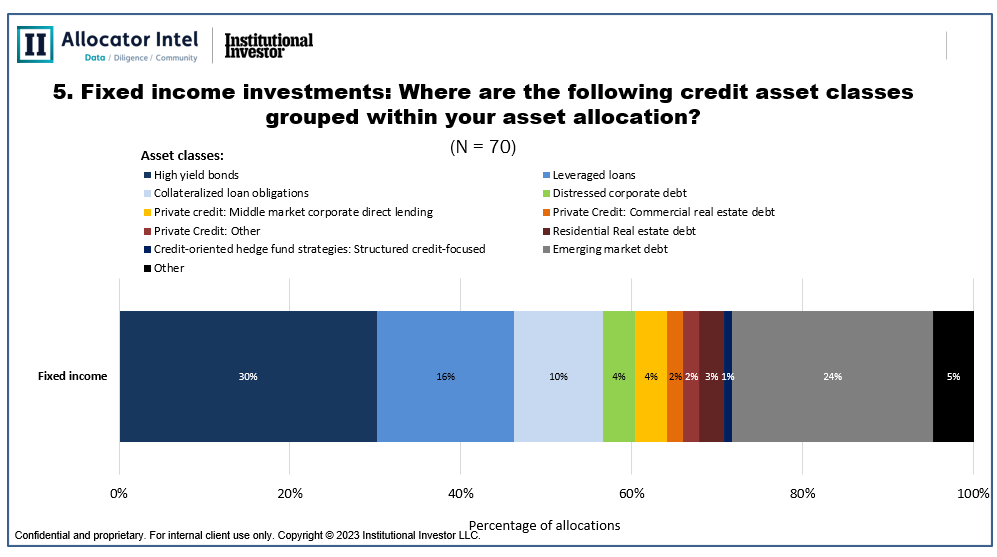

Confidence in current holdings was high among the following areas:

1. High yield bonds

2. Leveraged loans

3. Collateralized loan obligations

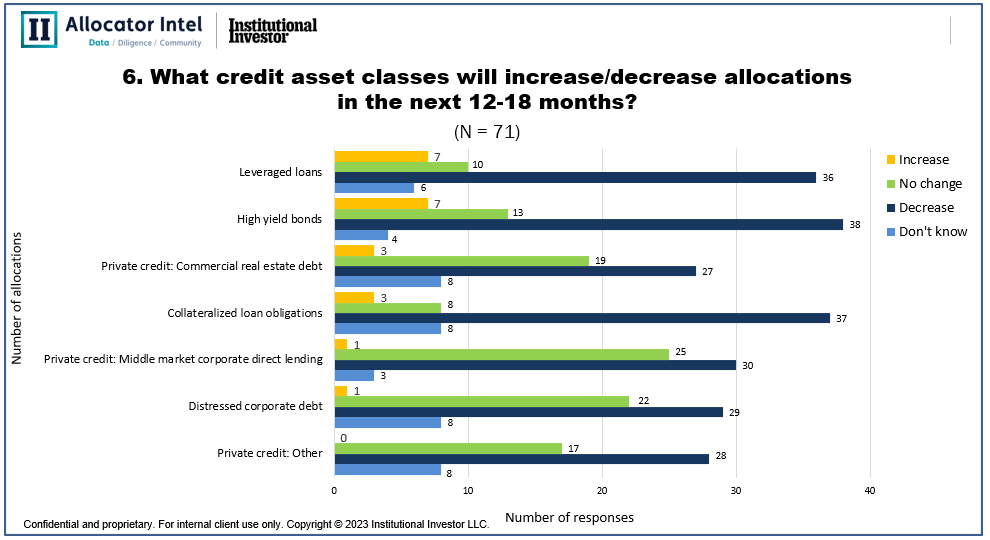

The sub classes in which respondents expressed intent to increase included:

1. Leveraged loans

2. High yield bonds

Download the full report here or below

To discuss the content of this article or gain access to like content Log In or Request Membership Here.