It’s called the Yale Model, but it might just as easily be known as the Swensen Model. David Swensen, the longtime head of the Yale University endowment, who passed away earlier this week, created an approach to investing that has been widely imitated by scores of endowments and foundations. Swensen took issue with the traditional heavy reliance on publicly traded stocks and bonds. He argued that nonprofits like Yale expected to exist in perpetuity and therefore could withstand the risks and volatility associated with nonpublic investments in order to capture substantial illiquidity premia.

After earning a Ph.D. at Yale in 1980, Swensen worked at Salomon Brothers and Lehman Brothers before returning to his alma mater in 1985, famously taking an 80% pay cut to run its investment office. Over the next few years he created a unique portfolio, shocking many with its modest allocations to public markets and heavy commitment to alternatives. But the results were impressive.

After earning a Ph.D. at Yale in 1980, Swensen worked at Salomon Brothers and Lehman Brothers before returning to his alma mater in 1985, famously taking an 80% pay cut to run its investment office. Over the next few years he created a unique portfolio, shocking many with its modest allocations to public markets and heavy commitment to alternatives. But the results were impressive.

His message spread not only because of the returns he posted but also because of the force of his personality. He shared his ideas with his staff members who often went on to create endowment portfolios based on the Yale model at a number of leading universities. By one count, nine women and five men who head higher education endowments all learned their craft from Swensen.

He spelled out his theories in his book, "Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment." Published in 2000, it became required reading at a number of business schools. For years he also taught a popular investment analysis course for undergraduates in the Yale School of Management. Indeed, on Monday, May 3, he taught the final session of the course for the spring semester and succumbed to cancer two days later. He was 67 years old.

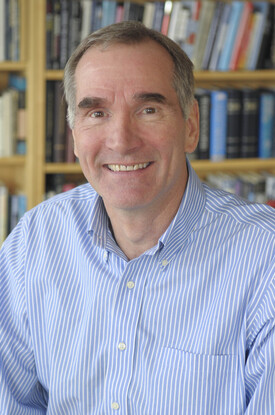

Swensen, whose mother was a Lutheran Minister and his father was a chemistry professor, grew up in River Falls, Wisconsin. At six-foot-five, he was a commanding presence in any room, and his manner combined a certain bluntness with a boyish enthusiasm for ideas and an academic’s verbal sophistication and precision. The Yale endowment, which stood at $1.3 billion when he took it over in 1985, now exceeds $31 billion.